read: 675 time:2022-03-21 16:45:57 from:

Adipic Acid Industry Chain

Adipic acid is an industrially important dicarboxylic acid, capable of a variety of reactions, including salt formation, esterification, amidation, etc. It is the main raw material for the production of nylon 66 fiber and nylon 66 resin, polyurethane and plasticizer, and plays an important role in chemical production, organic synthesis industry, medicine, lubricant manufacturing, etc. The production process of adipic acid is mainly divided into phenol, butadiene, cyclohexane and cyclohexene processes. At present, the phenol process has been largely eliminated, and the butadiene process is still in the research stage. Currently, the industry is dominated by the cyclohexane and cyclohexene processes, with benzene, hydrogen and nitric acid as raw materials.

Adipic Acid Industry Status

From the supply side of domestic adipic acid, the production capacity of adipic acid in China is growing slowly and the output is increasing slowly year by year. According to statistics, in 2021, adipic acid production capacity is 2.796 million tons/year, adipic acid production is 1.89 million tons, an increase of 21.53% year-on-year, and the capacity conversion rate is 67.60%.

From the demand side, the apparent consumption of adipic acid rises steadily at a low growth rate year by year from 2017-2020. According to statistics, in 2021, downstream demand for PU paste recovers and apparent consumption of adipic acid grows rapidly, with annual apparent consumption of 1.52 million tons, up 30.08% year-on-year.

From the structure of domestic adipic acid demand, PU paste industry accounts for about 38.20%, raw shoe soles account for about 20.71% of the total demand, and nylon 66 accounts for about 17.34%. And international adipic acid is mainly used to produce nylon 66 salt.

Import and export status of adipic acid industry

From the import and export status, China's external exports of adipic acid are much larger than imports, and the export amount has risen as the adipic acid market price continues to rise. According to statistics, in 2021, the export quantity of adipic acid in China was 398,100 tons, and the export amount was USD 600 million.

From the distribution of export destinations, Asia and Europe accounted for a total of 97.7% of exports. The top three are Turkey with 14.0%, Singapore with 12.9% and the Netherlands with 11.3%.

Competition pattern of adipic acid industry

In terms of market competition pattern (by capacity), domestic adipic acid production capacity is relatively concentrated, with the top five adipic acid manufacturers accounting for 71% of the country's total production capacity. According to statistics, the CR5 situation of adipic acid in China in 2021 is: Huafeng Chemical (750,000 tons, accounting for 26.82%), Shenma Nylon (475,000 tons, accounting for 16.99%), Hualu Hensheng (326,000 tons, accounting for 11.66%), Jiangsu Haili (300,000 tons, accounting for 10.73%), Shandong Haili (225,000 tons, accounting for 8.05%).

Future development trend of adipic acid industry

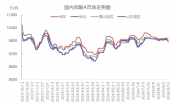

1. Price difference is in an upward cycle

In 2021, the price of adipic acid showed a fluctuating upward trend due to the rising price of downstream raw materials, and on February 5, 2022, the price of adipic acid was 13,650 yuan/ton, which was at a historical high. Influenced by the rising price of pure benzene, adipic acid spread fell to a historical low in the first half of 2021, and since October 2021, raw material prices have fallen back and adipic acid spread has increased accordingly. adipic acid spread was RMB5,373/ton on February 5, 2022, higher than the historical average.

2.PBAT and nylon 66 production to stimulate demand

With the promulgation of plastic restriction, domestic PBAT demand growth, more projects under construction; in addition, the localization of adiponitrile to solve the problem of nylon 66 raw material neck, under construction and planning adiponitrile capacity of more than 1 million tons, the release of domestic adiponitrile capacity to accelerate the domestic nylon 66 ushered in a period of rapid growth in capacity, adipic acid will usher in a new round of demand growth.

Currently under construction and planning PBAT capacity of more than 10 million tons, of which 4.32 million tons are expected to be put into production in 2022 and 2023, a ton of PBAT consumes about 0.39 tons of adipic acid, forming a demand for adipic acid of about 1.68 million tons; under construction and planning nylon 66 capacity of 2.285 million tons, a ton of nylon 66 consumes about 0.6 tons of adipic acid, forming a demand for adipic acid of about 1.37 million tons.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials