read: 563 time:2024-11-11 11:04:06 from:

On November 9th, the first batch of polypropylene products from Jincheng Petrochemical's 300000 tons/year narrow distribution ultra-high molecular weight polypropylene unit were offline. The product quality was qualified and the equipment operated stably, marking the successful trial production and start-up of the unit.

This device adopts advanced process technology and can flexibly adjust the production plan according to the catalyst used. It produces hundreds of grades of polypropylene products with high purity, meeting the needs of customized products.

The high-end polypropylene products produced by this device use metallocene catalysts independently developed by Jincheng Petrochemical High end Synthetic Materials Research Institute, which can produce narrow distribution ultra-high molecular weight polypropylene, ultra-fine denier polypropylene fiber materials, hydrogen modified melt blown materials and other high-end polypropylene products; Using Ziegler Natta system polypropylene catalyst, produce products such as polypropylene wire drawing material, polypropylene fiber material, transparent polypropylene, and thin-walled injection molded polypropylene special material.

In recent years, Jincheng Petrochemical has focused on developing high-end polyolefin new materials, and the 300000 tons/year narrow distribution ultra-high molecular weight polypropylene plant is an important part of it. The successful operation of this plant is of great significance to the development of Jincheng Petrochemical's high-end polyolefin new materials industry chain. At present, Jincheng Petrochemical is still building 50000 tons/year 1-octene and 700000 tons/year high-end polyolefin new material projects. The construction has been completed and preparations for trial production and start-up are underway. Among them, 50000 tons/year of 1-octene is the first set in China, using advanced high carbon alpha olefin technology. The products are high carbon alpha olefin 1-hexene, 1-octene, and decene.

300000 tons/year narrow distribution ultra-high molecular weight polypropylene plant

Analysis of the Polypropylene Market

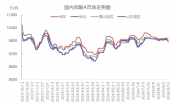

Characteristics of fluctuations in the domestic polypropylene market in 2024

During the period of 2020 to 2024, the domestic polypropylene market as a whole showed a trend of fluctuating upwards and then falling downwards. The highest price in the past five years occurred in the third quarter of 2021, reaching 10300 yuan/ton. By 2024, the polypropylene wire drawing market has experienced a rebound after a decline and presented a weak and volatile trend. Taking the wire drawing market in East China as an example, the highest price in 2024 appeared at the end of May at 7970 yuan/ton, while the lowest price appeared in mid to early February at 7360 yuan/ton. This fluctuation trend is mainly influenced by multiple factors. In January and February, due to the limited number of maintenance facilities in China and the low willingness of merchants to replenish their inventory before the holiday, the market prices showed weak upward momentum. Especially in February, due to the impact of the Spring Festival holiday, upstream inventory was under pressure, while downstream and terminal demand recovered slowly, resulting in a lack of effective cooperation in transactions and a price drop to the lowest point of 7360 yuan/ton this year.

Quarterly Market Performance and Future Prospects in 2024

Entering the second quarter of 2024, with the successive introduction of macroeconomic favorable policies, the activity of market funds has significantly increased, driving PP futures to rise. Meanwhile, lower than expected supply pressure and stronger costs have also driven the market upward. Especially in May, the market wire drawing price rose significantly, reaching the highest price of 7970 yuan/ton this year. However, as we entered the third quarter, the polypropylene market continued to decline. In July and August, the continuous decline of PP futures had a significant suppressive effect on the mentality of the spot market, deepening the pessimistic sentiment of merchants and causing the prices on the exchange to continuously decline. Although September is a traditional peak season, the beginning of the peak season has been relatively bleak due to negative factors such as falling oil prices and difficulty in improving supply and demand fundamentals. Downstream demand has also fallen short of expectations, leading to many negative factors in the domestic PP market and a continuous decline in price focus. In October, although the post holiday macro positive news heated up and spot offers briefly surged, cost support subsequently weakened, market speculation atmosphere cooled down, and downstream demand did not show obvious bright spots, resulting in poor market trading volume. As of the end of October, the mainstream price of wire drawing in China was hovering between 7380-7650 yuan/ton.

Entering November, the domestic polypropylene market still faces significant supply pressure. According to the latest data, the newly added polypropylene production capacity in China continued to be released in November, and the market supply further increased. Meanwhile, the recovery of downstream demand is still slow, especially in the terminal industries such as automobiles and home appliances, where the demand for polypropylene has not been significantly boosted. In addition, the fluctuations in the international crude oil market have also had an impact on the domestic polypropylene market, and the uncertainty of oil prices has increased market volatility. Under the interweaving of multiple factors, the domestic polypropylene market showed a volatile consolidation trend in November, with relatively small price fluctuations and market participants adopting a wait-and-see attitude.

By the fourth quarter of 2024, the domestic PP production capacity is expected to reach 2.75 million tons, mainly concentrated in the North China region, and the supply pattern in the North China region will undergo significant changes. By 2025, the domestic production of PP will not decrease, and the competition in the polypropylene market will become more intense, further expanding the supply-demand contradiction.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials