read: 1576 time:2024-09-25 11:26:07 from:

1、 Market Overview

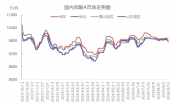

Recently, the domestic ABS market has continued to show a weak trend, with spot prices continuously falling. According to the latest data from the Commodity Market Analysis System of Shengyi Society, as of September 24th, the average price of ABS sample products has fallen to 11500 yuan/ton, a decrease of 1.81% compared to the price at the beginning of September. This trend indicates that the ABS market is facing significant downward pressure in the short term.

2、 Supply side analysis

Industry load and inventory situation: Recently, although the load level of the domestic ABS industry has rebounded to around 65% and remained stable, the resumption of early maintenance capacity has not effectively alleviated the situation of oversupply in the market. The on-site supply digestion is slow, and the overall inventory remains at a high level of about 180000 tons. Although the pre National Day stocking demand has led to a certain reduction in inventory, overall, the supply side's support for ABS spot prices is still limited.

3、 Analysis of Cost Factors

Upstream raw material trend: The main upstream raw materials for ABS include acrylonitrile, butadiene, and styrene. At present, the trends of these three are different, but overall their cost support effect on ABS is average. Although there are signs of stabilization in the acrylonitrile market, there is insufficient momentum to drive it higher; The butadiene market is affected by the synthetic rubber market and maintains a high consolidation, with favorable factors present; However, due to a weak supply-demand balance, the market for styrene continues to fluctuate and decline. Overall, the trend of upstream raw materials has not provided strong cost support for the ABS market.

4、 Interpretation of demand side

Weak terminal demand: As the end of the month approaches, the main terminal demand for ABS has not entered the peak season as expected, but has continued the market characteristics of the off-season. Although downstream industries such as home appliances have ended the high-temperature holiday, the overall load recovery is slow and demand recovery is weak. Traders lack confidence, their willingness to build warehouses is low, and market trading activity is not high. In this situation, the demand side's assistance to the ABS market situation appears particularly weak.

5、 Outlook and Forecast for the Future Market

The weak pattern is difficult to change: Based on the current market supply and demand situation and cost factors, it is expected that domestic ABS prices will continue to maintain a weak trend in late September. The sorting situation of upstream raw materials is difficult to effectively boost the cost of ABS; At the same time, the weak and rigid demand situation on the demand side continues, and market trading remains weak. Under the influence of multiple bearish factors, the expectations of the traditional peak demand season in September have not been realized, and the market generally holds a pessimistic attitude towards the future. Therefore, in the short term, the ABS market may continue to maintain a weak trend.

In summary, the domestic ABS market is currently facing multiple pressures of oversupply, insufficient cost support, and weak demand, and the future trend is not optimistic.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials