read: 637 time:2022-05-12 17:57:01 from:

Since March, there are new crown cases in many places in China, the situation in Shanghai and Jilin is the most serious, and the city closure lasts longer, so it has caused serious impact on logistics and transportation, production and business activities. Shanghai and Jilin happen to be important regions for China's auto industry, with vehicle manufacturers and auto parts companies having layouts in and around the region.

As a result of the epidemic, auto production and sales plummeted in April. Data show that the national passenger car market retailed 1.042 million units in April, down 35.5% year-on-year and 34.0% sequentially; the national passenger car production in April was 969,000 units, down 41.1% year-on-year and 46.8% sequentially.

After Shanghai entered the closure control at the end of March, most OEMs entered the first batch of "white list" announced by Shanghai to resume work and production, and gradually resumed work and production in mid-April. However, due to logistics and transportation constraints, parts supply and staff shortage, some plants were still operating at less than 50% of their pre-epidemic capacity even after resuming work.

Auto production and sales are sluggish, so it also drags down the demand for tires. Data show that in April, China's tire start rate also fell significantly year-on-year, including all-steel tire start rate fell nearly 30% year-on-year. And the lack of demand support for tires eventually led to the synthetic rubber market transactions are light, inventory levels continue to rise, so the price of butylbenzene, butyl rubber has been falling. in April, butylbenzene 1502 rubber downward price adjustment four times, a cumulative decline of 1200 yuan / ton.

While raw material prices remained at high levels during the same period, synthetic rubber profits were further compressed, of which SBR losses were particularly serious. Some private SBR factories said that in the short term or continue to reduce the negative, but also may stop the maintenance plan.

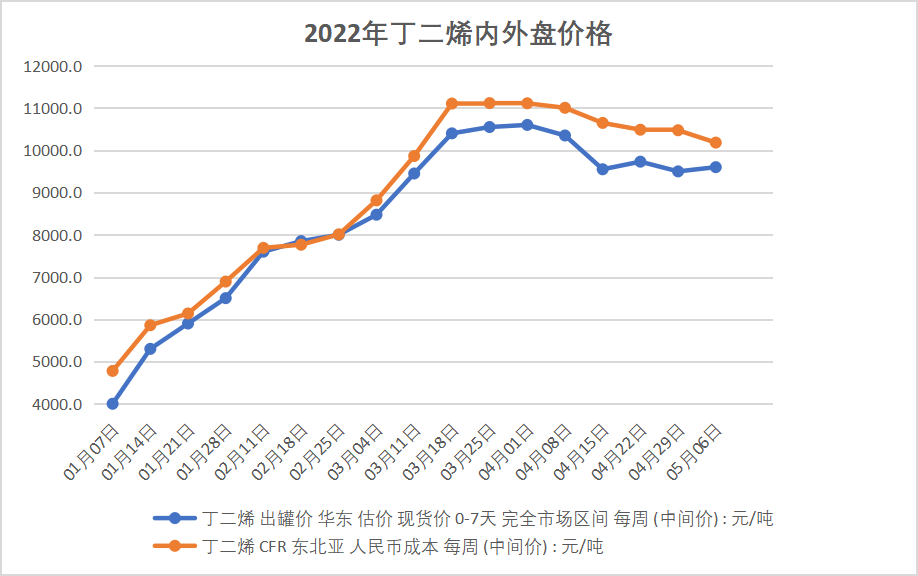

Due to the weak demand for synthetic rubber, butadiene started to fall after reaching a yearly price high at the end of March. the average price of butadiene out of the tank in east China was 9,600 yuan/ton on May 7, compared with 10,650 yuan/ton on March 28, down nearly 10%.

The domestic auto supply chain was hit, overlaid with butadiene plant maintenance support, and downstream buying in Japan and Korea was moderate. Compared to domestic RMB prices for butadiene, CFR Northeast Asia USD prices were firmer, and the RMB inverse USD margin increased further since March.

*Butadiene CFR Northeast Asia RMB conversion price = CFR Northeast Asia * exchange rate * 1.02 * 1.13

Also the devaluation of the RMB has further stimulated China's butadiene exports. According to statistics, 7 shipments of Chinese export cargoes loaded in April-May have been sold so far.

Before the domestic epidemic improves and the production and operation order and the supply of the automotive industry chain improves significantly, the downstream demand for butadiene may continue to decrease and Chinese butadiene exports may further increase as this strong external and weak internal situation continues.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials