read: 783 time:2022-07-04 10:36:19 from:

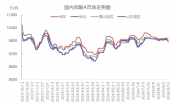

Since June, domestic toluene, xylene emissions rose rapidly after the decline, the end of the month rose again, the overall "n" trend. As of the end of June, East China, toluene market closed at about 8975 yuan / ton, up 755 yuan / ton from 8220 yuan / ton at the end of June; East China information isomerization of xylene closed at about 8750 yuan / ton. Compared with the average closing price of 8180 in the previous month, it was up 570 yuan/ton. At the end of November, toluene/xylene market prices rose more than $1,000 from the beginning of the month, reaching an 8-9 year high since March/December 2013. However, the sharp rise followed by the plunge also put pressure on the market. On the one hand, crude oil once plunged in the middle of this month due to the OPEC+ production increase intention and the Fed policy environment, with weak external support; on the other hand, benzene and benzene prices were high, and the profit development space for downstream products narrowed significantly. Therefore, the analysis of China's actual domestic production and life demand is not enough, the issue of external demand is limited, the supply and demand balance is not balanced, the market is not affected, the price fluctuations.

Looking at the July market, the international and domestic crude oil futures trading cost price pivot or such a country moderate downward correction, however, should be able to be more cautious beware of crude oil products and services market continues to develop in the process by many companies in order to further geo-economic ideological and political work life events and energy sudden cut-offs, the current with China's financial market competition environmental protection still can not Found that there are certain differences produce huge upside social credit risk, which means we mean that in July crude oil or continue to learn to try to maintain a wide range of oscillations, but the overall weakness of the possibility of high, WTI price pivot down to near $ 105 / barrel, "Brent - WTI" spread or further widen. From the perspective of supply, Renqiu Petrochemical and other aromatic hydrocarbons are scheduled to shut down for maintenance in July, but Shenyang Wax Plant and others may restart, so internal supply remains relatively stable. Meanwhile, there is still a reverse arbitrage window on the dollar segment side, and the overseas supply side is conducive to improving the domestic travel market. From the aspect of demand theoretical analysis method, downstream toluene disproportionation and external extraction MX PX device data for accounting profit is in danger, and refined oil companies cultural market is weak to run, is expected to be difficult to achieve in July through the network formation to provide a strong technical industrial support.

Comprehensive analysis, at present, the external and fundamental support can be described as a poor performance. Therefore, it is still expected that the domestic toluene and xylene market in July will be weak and oscillating.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with port, wharf, airport and railway transportation network, and in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan in China, with chemical and dangerous chemical warehouses, with a year-round storage capacity of more than 50,000 tons of chemical raw materials, with sufficient supply of goods.chemwin E-mail: service@skychemwin.com whatsapp:19117288062 Phone:+86 4008620777 +86 19117288062

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials