read: 662 time:2023-05-16 13:26:10 from:

With the acceleration of the scale of China's chemical industry, the homogenization brought by scale has become increasingly severe. Many powerful enterprises are actively expanding into the Southeast Asian consumer market, and can alleviate concerns about oversupply in the Chinese market by taking the lead in seizing potential Southeast Asian consumer markets.

This article mainly analyzes the main types and scales of chemicals exported from China to Singapore. Let's take a look at which chemicals are exported from China to Singapore?

(1) Singapore has the largest import scale of oil and related products from China

According to the statistics of chemical products exported from China to Singapore, oil products and related products are the main products exported from China to Singapore in 2022. Among them, the export scale of gasoline, ethanol gasoline, and component oil to Singapore in 2022 exceeded 6 million tons, while the export scale of diesel, catalytic diesel, and ethylene tar to Singapore exceeded 2.5 million tons, the export scale of marine fuel oil to Singapore exceeded 1.5 million tons, and the export scale of kerosene to Singapore exceeded 800000 tons. In addition, there is a small amount of crude oil exported to Singapore.

Although Singapore is an important transportation hub in Southeast Asia, its own number of refineries is relatively small, with only companies such as Mobil and Shell in the Jurong Island Industrial Park. Moreover, these integrated refining and chemical enterprises mostly focus on chemical production, with less oil production. So, this also leads to a gap in Singapore's oil supply, which mainly relies on the supplement of Chinese oil exports and mainly comes from the exports of Chinese main enterprises.

The oil and related products exported from China to Singapore have shown a continuous growth trend in recent years. The development of Singapore's refining industry has stagnated, while the economic development has brought more demand for oil for civilian and industrial vehicles. So, Pingtou Brother expects that in the long term, Singapore's oil products will mainly come from the Chinese market, and Singapore will also become an important consumer market for Chinese oil exports.

(2) Aromatic solvent oil, mixed aromatic hydrocarbons, and related blending materials are the main chemical products exported from China to Singapore

According to customs data statistics, in the chemical products exported from China to Singapore in 2022, the export volume under the tax code of aromatic solvent oil, xylene, mixed aromatic hydrocarbons, hydrogenated xylene, non aromatic hydrocarbons, and mixed benzene exceeded 40000 tons, making it a relatively large variety among the chemical products counted. Next are oil additives, chlorinated paraffins, plastic foaming agents, zinc oxide, electrolytes, monoglycerides, epoxy resins, methoxyacrylate fungicides, hydrazine hydrate 2, liquefied MDI, F141B foaming agents, and slurries. Under this tax code, the scale of China's exports to Singapore exceeds 30000 tons.

It can be seen that from the scale of China's exports to Singapore, excluding products directly related to oil products, oil blending raw materials are also the main export products. Among them, mixed aromatic hydrocarbons, oil additives, and non aromatic blended oils are mainly exported to the oil market after being exported to Singapore.

Therefore, Singapore is currently the main consumer type of chemical products for oil products and blending materials, and its import purpose is also to meet the local consumption demand for finished oil markets.

(3) Chemicals such as water reducing agents, EVA membranes, methyl acetate and other special esters, MDI, etc. are the largest imports of non oil products

According to customs statistics, in 2022, China will export more than 20000 tons of water reducing agent to Singapore, more than 15000 tons of EVA film, CPP film, agricultural film, aluminized film, conveyor belt and other products, and more than 10000 tons of methyl acetate, ethyl acetate, sec butyl acetate, ethylene glycol methyl ether acetate, vinyl carbonate (VC), methyl ethyl acetate (EMC), ethylene carbonate (EC) to Singapore, The scale of pure MDI exports to Singapore exceeds 8300 tons.

From the perspective of non oil products and related chemicals exported from China to Singapore, they are mainly concentrated in water reducing agents, acetate esters, and fine chemicals. However, the export scale is not high, and the export volume is generally around 10000 to 20000 tons, with some products only weighing a few thousand tons. From this point, it can also be seen that Singapore's own consumption demand for chemicals is not high. On the one hand, it has a complete industrial chain with few missing links, and there is no need to purchase chemicals for chain replenishment operations. On the other hand, the consumption volume of Singapore's chemical industry is not large, and its own chemical supply can basically meet the needs of the local consumer market.

So, if the Singapore chemical industry market continues to develop in the future, without the investment and construction of large-scale integrated enterprises, it will not be possible to form a supplementary demand for the scale driving and chain of chemicals. For the Chinese market, the export of Chinese chemicals to Singapore has limited market space.

(4) The scale of China's chemical and plastic products' transit trade from Hong Kong

According to Chinese customs statistics, according to the customs statistics of China's exports, some chemicals are exported from China to Hong Kong for re export, and the main consumer market for re export is Southeast Asia, with Singapore being an important destination for re export.

So, if we consider the situation of Hong Kong's transit, the overall export volume of chemicals from China to Singapore, including related plastic particles, acetate chemicals, and other plastic products, will also increase. It should be noted that due to the small volume of chemicals in Hong Kong's transit trade, it will not have a significant bias on the conclusions of our analysis.

(5) Jurong Island, Singapore is the largest chemical hub in Singapore

According to online data, Jurong Island in Singapore is an artificial island located off the southwest coast of Singapore, and also the largest outer island in Singapore, with a total area of nearly 32 square kilometers. During the land reclamation project, seven small islands (Aicha Bay Island, North Sai Island, Merimo Island, Aimei Treasure Island, Shakla Island, Little North Sai Island, and Silaya Island) were connected by reclamation to form a large island, Three times larger than the original land area.

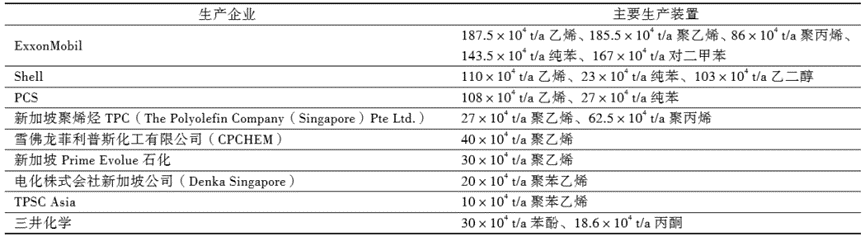

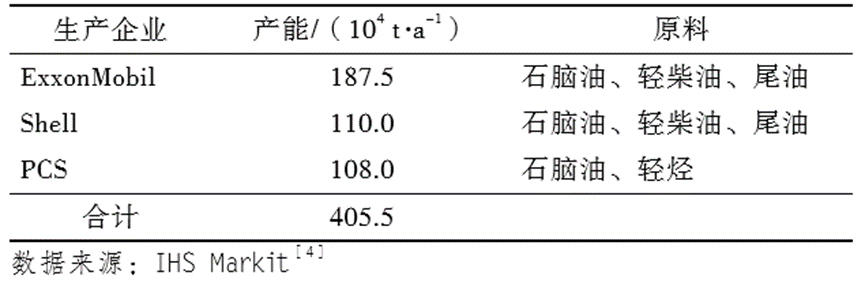

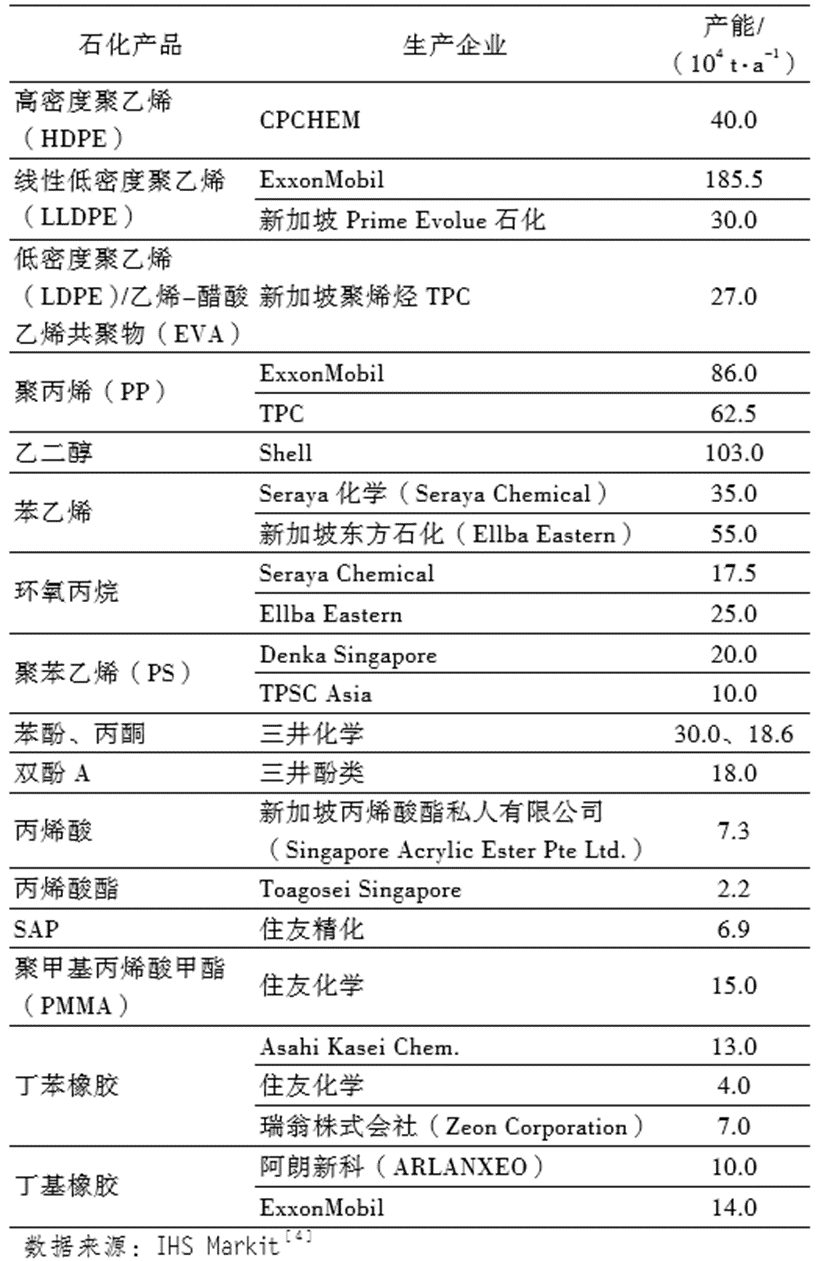

There are 95 international companies operating on Jurong Island, including industry giants such as Royal Dutch Shell, ExxonMobil, Chevron, DuPont, BASF, Sumitomo Chemical, and Mitsui Chemical. The petrochemical industry in Jurong Island is mainly divided into three categories: firstly, the refining and petrochemical (ethylene, chemical fiber) industries, with representative enterprises such as ExxonMobil and Shell; The second is the special chemical and liquid storage industries, represented by three major professional storage tank companies - Vopak, Oiltanking, and Tankstore; The third is the public engineering system that provides services for the cluster, represented by companies such as Sanbawang Company and Shengke Natural Gas Company. Among them, the refining and petrochemical industries are led by ExxonMobil, Shell, and Singapore Petrochemical Company (PCS), developing synthetic resin, ethylene glycol, aromatics and other products downstream.

Table 1 Capacity of Major Bulk Petrochemical Product Suppliers in Singapore (Data Source: Super Petrochemical)

Table 2: Producers and Raw Materials of Ethylene Plants in Singapore (Data Source: Super Petrochemical)

Table 3: Production Enterprises and Capacity of Some Petrochemical Products in Singapore (Data Source: Super Petrochemical)

Among Southeast Asian countries, Singapore is the country with the highest degree of chemical industry scale, the most complete industrial chain support, the largest market size in Southeast Asia, and also the country with the most advanced chemical technology level. The consumer market for chemicals in Singapore is slowly growing, but there is limited space for the supply of chemical products, which also provides potential consumer markets and opportunities for Chinese exports of chemicals to Singapore in the future.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials