read: 602 time:2022-03-30 11:29:18 from:

The main raw materials of polyether, such as propylene oxide, styrene, acrylonitrile and ethylene oxide, are downstream derivatives of petrochemicals, and their prices are affected by macroeconomic and supply and demand conditions and fluctuate frequently, which makes it more difficult to control costs in the polyether industry. Although the price of propylene oxide is expected to decline in 2022 due to the concentration of new production capacity, the cost control pressure from other major raw materials still exists.

The unique business model of polyether industry

The cost of polyether products is mainly composed of direct materials such as propylene oxide, styrene, acrylonitrile, ethylene oxide, etc. The structure of the above raw material suppliers is relatively balanced, with state-owned enterprises, private enterprises and joint ventures all occupying a certain proportion of the production scale, so the company's upstream raw material supply market information is more transparent. In the downstream of the industry, polyether products have a wide range of application areas, and the customers show the characteristics of large volume, dispersion and diversified demand, so the industry mainly adopts the business model of "production by sales".

Technology level and technical characteristics of polyether industry

At present, the national recommended standard of polyether industry is GB/T12008.1-7, but each manufacturer is implementing its own enterprise standard. Different enterprises produce the same kind of products due to differences in formulation, technology, key equipment, process routes, quality control, etc., there are certain differences in product quality and performance stability.

However, some enterprises in the industry have mastered the key core technology through long-term independent R&D and technology accumulation, and the performance of some of their products has reached the advanced level of similar products abroad.

Competition pattern and marketization of polyether industry

(1) International competition pattern and marketization of polyether industry

During the 13th Five-Year Plan period, the global production capacity of polyether is growing in general, and the main concentration of production capacity expansion is in Asia, among which China has the most rapid capacity expansion and is an important global production and sales country of polyether. China, the United States and Europe are the world's major polyether consumers as well as the world's major polyether producers. From the point of view of production enterprises, at present, the world polyether production units are large in scale and concentrated in production, mainly in the hands of several large multinational companies such as BASF, Costco, Dow Chemical and Shell.

(2) Competition pattern and marketization of domestic polyether industry

China's polyurethane industry started in the late 1950s and early 1960s, and from the 1960s to the early 1980s, the polyurethane industry was in the nascent stage, with only 100,000 tons/year of polyether production capacity in 1995. Since 2000, with the rapid development of domestic polyurethane industry, a large number of polyether plants have been newly built and polyether plants have been expanded in China, and the production capacity has been growing continuously, and polyether industry has become a fast-developing chemical industry in China. The polyether industry has become a fast growing industry in China's chemical industry.

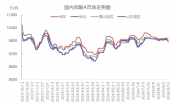

The trend of profit level in polyether industry

The profit level of the polyether industry is mainly determined by the technical content of the products and the value-added of the downstream applications, and is also influenced by the fluctuation of raw material prices and other factors.

Within the polyether industry, the profit level of enterprises varies greatly due to differences in scale, cost, technology, product structure and management. Enterprises with strong R&D capabilities, good product quality and large-scale operations usually have strong bargaining power and relatively high profit levels due to their ability to produce high quality and high value-added products. On the contrary, there is a trend of homogeneous competition of polyether products, its profit level will remain at a lower level, or even declining.

Strong supervision of environmental protection and safety supervision will regulate the industry order

The "14th Five-Year Plan" clearly puts forward that "the total emissions of major pollutants will continue to be reduced, the ecological environment will continue to improve, and the ecological security barrier will be more solid". Increasingly stringent environmental standards will increase corporate environmental investment, forcing companies to reform production processes, strengthen green production processes and comprehensive recycling of materials to further improve production efficiency and reduce the "three wastes" generated, and improve product quality and value-added products. At the same time, the industry will continue to eliminate the backward high energy consumption, high pollution production capacity, production processes and production equipment, making a clean environment

At the same time, the industry will continue to eliminate backward high energy consumption, high pollution production capacity, production processes and production equipment, so that enterprises with clean environmental protection production process and leading R & D strength stand out, and promote accelerated industrial integration, so that enterprises in the direction of intensive development, and ultimately promote the healthy development of the chemical industry.

Seven barriers in the polyether industry

(1) Technical and technological barriers

As the application fields of polyether products continue to expand, the requirements of downstream industries for polyether also gradually show the characteristics of specialization, diversification and personalization. The selection of chemical reaction route, formulation design, catalyst selection, process technology and quality control of polyether are all very critical and have become the core elements for enterprises to participate in market competition. With the increasingly stringent national requirements on energy saving and environmental protection, the industry will also develop in the direction of environmental protection, low carbon and high value-added in the future. Therefore, mastering key technologies is an important barrier to enter this industry.

(2) Talent barrier

The chemical structure of polyether is so fine that small changes in its molecular chain will cause changes in product performance, thus the precision of production technology has strict requirements, which requires high level of product development, process development and production management talents. The application of polyether products is strong, which requires not only the development of special products for different applications, but also the ability to adjust the structure design at any time with the downstream industry products and professional after-sales service talents.

Therefore, this industry has high requirements for professional and technical talents, who must have solid theoretical foundation, as well as rich R&D experience and strong innovation ability. At present, domestic professionals with solid theoretical background and rich practical experience in the industry are still relatively scarce. Usually, enterprises in the industry will combine the continuous introduction of talents and follow-up training, and improve their core competitiveness by establishing a talent mechanism suitable for their own characteristics. For new entrants to the industry, the lack of professional talents will form a barrier to entry.

(3) Raw material procurement barrier

Propylene oxide is an important raw material in the chemical industry and is a hazardous chemical, so the purchasing enterprises need to have safety production qualification. Meanwhile, domestic suppliers of propylene oxide are mainly large chemical companies such as Sinopec Group, Jishen Chemical Industry Company Limited, Shandong Jinling, Wudi Xinyue Chemical Company Limited, Binhua, Wanhua Chemical and Jinling Huntsman. The above-mentioned enterprises prefer to cooperate with enterprises with stable propylene oxide consumption capacity when selecting downstream customers, forming interdependent relationships with their downstream users and focusing on the long-term and stability of cooperation. When new entrants in the industry do not have the ability to consume propylene oxide stably, it is difficult for them to obtain stable supply of raw materials from manufacturers.

(4) Capital barrier

The capital barrier of this industry is mainly reflected in three aspects: firstly, the necessary technical equipment investment, secondly, the production scale needed to achieve economies of scale, and thirdly, the investment in safety and environmental protection equipment. With the speed of product replacement, quality standards, personalized downstream demand and higher safety and environmental standards, the investment and operating costs of enterprises are rising. For new entrants to the industry, they must reach a certain economic scale in order to compete with existing enterprises in terms of equipment, technology, costs and talent, thus constituting a financial barrier to the industry.

(5) Management System Barrier

The downstream applications of the polyether industry are extensive and scattered, and the complex product system and the diversity of customer demands have high requirements on the management system operation ability of suppliers. The services of suppliers, including R&D, trial materials, production, inventory management and after-sales, all require reliable quality control system and efficient supply chain for support. The above management system requires long time experiment and large amount of capital investment, which constitutes a great barrier to entry for small and medium-sized polyether manufacturers.

(6) Environmental protection and safety barriers

China's chemical enterprises to implement the approval system, the opening of chemical enterprises must meet the prescribed conditions and approved by the consent before engaging in production and operation. The main raw materials of the company's industry, such as propylene oxide, are hazardous chemicals, and enterprises entering this field must go through complex and strict procedures such as project review, design review, trial production review and comprehensive acceptance, and finally obtain the relevant license before they can officially produce.

On the other hand, with the social and economic development, the national requirements for safety production, environmental protection, energy saving and emission reduction are getting higher and higher, a number of small-scale, poorly profitable polyether enterprises will not be able to afford the increasing safety and environmental protection costs and gradually withdraw. Safety and environmental protection investment has become one of the important barriers to enter the industry.

(7) Brand Barrier

The production of polyurethane products generally adopts one-time molding process, and once the polyether as raw material has problems, it will cause serious quality problems to the whole batch of polyurethane products. Therefore, the stable quality of polyether products is often a priority factor for users. Especially for customers in the automotive industry, they have strict audit procedures for product testing, examination, certification and selection, and need to go through small batches, multiple batches and long time experiments and trials. Therefore, the creation of brand and the accumulation of customer resources require long-term and large amount of comprehensive resource investment, and it is difficult for new entrants to compete with the original enterprises in branding and other aspects in the short term, thus forming a strong brand barrier.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials