read: 1206 time:2022-06-09 10:57:21 from:

According to statistics, China's acrylic acid production will exceed 2 million tons in 2021, and acrylic acid production will exceed 40 million tons. The acrylate industry chain uses acrylic esters to produce acrylic esters, and then acrylic esters are produced through related alcohols. The representative products of acrylates are: butyl acrylate, isooctyl acrylate, methyl acrylate, ethyl acrylate and acrylic acid high absorbency resin. Among them, the production scale of butyl acrylate is large, with domestic production of butyl acrylate exceeding 1.7 million tons in 2021. The second is SAP, with production of more than 1.4 million tons in 2021. The third is isooctyl acrylate, with a production of more than 340,000 tons in 2021. the production of methyl acrylate and ethyl acrylate will be 78,000 tons and 56,000 tons respectively in 2021.

For applications in the industry chain, acrylic acid mainly produces acrylic esters, and butyl acrylate can be produced as adhesives. Methyl acrylate is used in the coating industry, adhesives, textile emulsions, etc. Ethyl acrylate is used as acrylate rubber and adhesive industry, which has some overlap with the application of methyl acrylate. Isooctyl acrylate is used as pressure-sensitive adhesive monomer, coating adhesive, etc. SAP is mainly used as a highly absorbent resin, such as diapers.

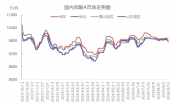

According to the related products in the acrylate industry chain in the past two years, gross margin (sales profit/sales price) comparison, the following results can be obtained.

1. in the acrylate industry chain in China, the profit margin at the upstream raw material end is the highest, with naphtha and propylene having relatively high profit margins. 2021 naphtha profit margin is around 56%, propylene profit margin is around 38%, and acrylic profit margin is around 41%.

2. Among acrylate products, the profit margin of methyl acrylate is the highest. The profit margin of methyl acrylate reaches about 52% in 2021, followed by ethyl acrylate with a profit of about 30%. The profit margin of butyl acrylate is only about 9%, isooctyl acrylate is in loss, and the profit of SAP is around 11%.

3. Among acrylate producers, more than 93% are equipped with upstream acrylic acid plants, while some are equipped with acrylic acid plants, most of which are concentrated in large enterprises. From the current profit distribution of the acrylate industry chain can be seen, acrylate producers equipped with acrylic acid can effectively ensure the maximum profit of the acrylate industry chain, while acrylate producers without acrylic acid equipped with acrylic acid is less economical.

4, among acrylate producers, the profit margin of large butyl acrylate has maintained a stable trend in the past two years, with a profit range of 9%-10%. However, due to market fluctuations, profit margins of special acrylic ester producers fluctuate greatly. This indicates that the market profit of large products is relatively stable, while small products are more susceptible to the impact of imported resources and market supply-demand imbalance.

5, from the acrylate industry chain can be seen, enterprises develop the acrylate industry chain, large-scale production direction for butyl acrylate, while special acrylate and SAP are produced in the supporting mode of butyl acrylate, which can improve the resistance of the market, but also a relatively reasonable production mode.

For the future, methyl acrylate, ethyl acrylate and isooctyl acrylate have their own downstream applications in the acrylate industry chain, and the downstream consumption shows positive growth trend. From the market supply and demand level, methyl acrylate and ethyl acrylate have a high oversupply problem and the future outlook is average. At present, butyl acrylate, isooctyl acrylate and SAP still have some room for development and are also the products with certain profitability in acrylate products in the future.

For the upstream end of acrylic acid, propylene and naphtha, whose raw material data are gradually increasing, the profitability of naphtha and propylene is expected to be higher than that of acrylic acid. Therefore, if companies develop the acrylate industry chain, they should pay more attention to the integration of the industry chain and rely on the development advantages of the industry chain, there will be market feasibility.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials