read: 710 time:2022-06-21 13:08:17 from:

International oil prices collapse and plunge nearly 7%

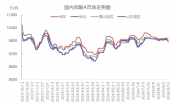

International oil prices collapsed nearly 7% over the weekend and continued their downward trend at the open on Monday due to market concerns about a slowing economy pulling down oil demand and a marked increase in the number of active oil rigs in North America.

By the end of the day, light crude oil futures for July delivery on the New York Mercantile Exchange fell $8.03, or 6.83 percent, to close at $109.56 per barrel, while Brent crude oil futures for August delivery in London fell $6.69, or 5.58 percent, to close at $113.12 per barrel.

Weak demand! Prices of a variety of chemicals dive!

The chemical industry is currently experiencing a general downturn in the market and a sharp decline in downstream demand. Many companies have chosen a more low-key and soft way to reduce their start-up rates to cope with the current low market situation. The tip of the iceberg in the deep sea, and which chemicals are under pressure?

Bisphenol A: the overall demand of the industry chain is weak, there is still room for downward movement

In the first half of this year, the average price of epoxy resin hovered above and below 25,000 yuan / ton, which also brought a certain impact on the demand for bisphenol A. The good policy on BPA and epoxy resin industry chain has been basically digested by the market, and the overall demand of BPA industry chain is weak at present. Downstream epoxy resin, PC contradictions are particularly prominent, the supply is relatively adequate and demand is difficult to follow up, it is expected that Bisphenol A still have downward space.

Polyether: downstream sluggish buying strength is weak, the industry price war is difficult to have a winner

The end of the Dragon Boat Festival holiday, polyether demand opened a downward channel, order transactions are scarce, the pressure of new orders to follow up gradually, polyether negotiation shipments go down, in the cost and demand for dual weakness, cyclopropane open down mode, polyether actively follow the decline of cyclopropane, downstream buying strength of raw materials is still weak, the overall market sluggishness, prices continue to maintain downward running. In addition, the three giants of polyether price war fierce, in the domestic demand downturn, foreign prices are still lower than domestic prices, coupled with foreign epidemics still continue to develop, demand is significantly reduced, polyether exports for the time being no good support.

Epoxy resin: domestic and foreign trade are hampered at the same time, and the mainstream price is on the low end

This round of epoxy resin prices, whether it is a first-line, second-line or third-line brands, solid offer at 21,000 yuan / ton, liquid offer at about 23,500 yuan / ton, compared with last year, reduced by about 5,000 yuan / ton, the mainstream of the low end. However, it is still difficult for downstream demand to pick up, and the export-oriented economy has encountered the world economic downturn, and exports are hindered. Consumption is currently in a downward trend, and epoxy resin picking is also affected.

Ethylene oxide: the biggest downstream entered the off-season, and the fresh demand is not enough to follow up

The largest downstream of ethylene oxide polycarboxylate water reducing agent monomer entered the seasonal off-season, and the demand is facing a weak market in the off-season. Entering June, the rainy season increased significantly, the overall consumption will show a significant decline is expected. In addition, the terminal downstream is still facing the pressure of payback, the immediate demand is not enough to follow up, and the stock game is obvious. In the future, downstream inventory is still the main tone, polycarboxylic acid water reducing agent monomer will show a stable to weak operation, while the consumption of ethylene oxide will show a lack of trend.

Glacial acetic acid: downstream due to losses to reduce the negative, livelihood consumption reduction to accelerate the onset of the off-season

The two waves of bottoming prices in the first half of the year are based on locking in the level of 3400-3500 yuan/ton, the main factor lies in the low demand just now. Downstream product load are low, most of them due to loss reduction and parking maintenance, resulting in a low level of start-up rate. And the traditional off-season itself just demand decline, plus the impact of the first half of the epidemic in many places to reduce consumption of people's livelihood, the industry chain under the role of conduction to reduce the demand for raw materials, downstream procurement intentions for the spot is scarce.

Butyl alcohol: downstream butyl acrylate demand is flat, prices fell 500 yuan / ton

Into June, n-butanol market shocks run, downstream demand is slightly weak, the field transactions are not high, the market situation has been declining, compared to the opening market prices at the beginning of the week fell 400-500 yuan / ton. Butyl acrylate market, the largest downstream of n-butanol, weak performance, the overall downstream industry tape master rolls and acrylate emulsions and other demand is flat, gradually enter the off-season demand, spot traders deal poorly, the market center of gravity narrowly softened.

Titanium dioxide: the start rate of only 80%, the downstream shortcomings are difficult to change

The domestic titanium dioxide market has been weak, manufacturers receiving orders less than expected, the market transport restrictions on a large scale, the current titanium dioxide enterprises overall opening rate of 82.1%, downstream customers are currently in the inventory consumption stage, sporadic large plants and some small and medium-sized manufacturers to take the initiative to reduce the load, the current domestic titanium dioxide market, such as real estate and other terminal industries are expected to run on the short side is difficult to change, the short-term view due to foreign Supplier capacity release space is very limited, so domestic sales and foreign trade will be negative.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials