read: 780 time:2022-09-15 13:54:37 from:

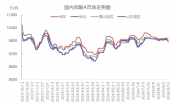

Since late August, the domestic chemical market has rebounded after bottoming. As of September 9, the Zhuochuang Information Organic Chemical Price Index closed at 1252.8, rebounding 5.2% from the annual low on August 22 (see Figure 1). The chemical fiber price index and plastic price index rose 1.1% and 1.4% respectively, while the crude oil fell 4.0% in the same period. From the rising range, among the 100 chemicals highlighted by Zhuochuang Information, 73 chemicals rose in this stage, accounting for 73%; 8 were stable, accounting for 8%; 19 fell, accounting for 19%.

Supply tightening and marginal improvement of demand, chemical market returning to fundamental logic

Recently, the international oil price has fluctuated and dropped, and on September 7, it once again set a new low after the Russian Ukrainian conflict, causing the cost support of the chemical market to move downward. However, as the industry has continued to limit production and the supply side has tightened in recent years, the current social inventory is generally at a relatively low level. After entering the traditional consumption peak season of "Golden Ninth", the market confidence has been slightly restored, and the demand side has also improved marginally. Therefore, the chemical industry market has shown an upward trend of shock from the shackles of crude oil. The recent trend of the chemical market and crude oil "diverged", indicating that the market returned to the fundamental logic after a long period of cost dominance.

The price rises, the cost moves down, and the profitability of the industry has been restored

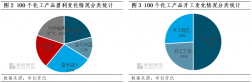

The decline of crude oil has led to a downward shift in the cost side, and after the recent rise, the operation of the chemical industry has also improved. Among the 100 chemical products highlighted by Zhuochuang Information, 53 have improved their operating conditions (including profit increase, loss to profit and loss reduction), accounting for 53%, of which 34 have increased their profits and changed from loss to profit (see Figure 2). There are 47 cases of poor operating conditions (including three cases of profit reduction, loss expansion and profit to loss), accounting for 47%. Compared with the situation of general losses in the previous period, the current operating situation of the chemical industry has improved, but looking at the whole industry, the loss is still relatively large.

"Jinjiu" is not good enough, and we should be vigilant to reverse the supply and demand pattern

With the rise of price and improvement of operation, the current market mentality has been restored, especially for the products with profit growth, the production intention of enterprises has been improved, so the starting load of some products has rebounded. According to the statistics of Zhuochuang Information on 100 key chemicals, 50% of the construction starts have rebounded since late August, 26% have been stable, and only 24% have declined (see Figure 3). Since this year, the demand for chemical products has been continuously tested, especially in the case of sluggish performance in real estate, household appliances and other related terminal demand fields, the consumption of raw materials has decreased significantly compared with previous years. Although it is currently in the peak consumption season of "nine gold and ten silver", the current demand side repair efforts still need to be further enhanced.

On the whole, with the improvement of demand, it is expected that the chemical market will still operate in a relatively strong way in the short term. In addition, although the crude oil rebounded again after falling, the recent decline has become more smooth, the cost side has been unstable or affected market sentiment, and the terminal recovery is not strong, so the space for continuing to rise is relatively limited. In addition, supply has rebounded under the conditions of good demand and profit recovery, and the potential reversal of supply and demand pattern in the later period also needs attention.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials