read: 2683 time:2022-09-20 11:26:39 from:

Analysis and forecast of world acetone supply

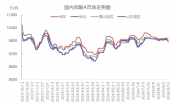

the world acetone production capacity increased slightly, and the output and demand increased rapidly. In 2021, the world acetone production capacity will increase by 1.0% year on year, and the output and demand will increase by 8.8% year on year. Northeast Asia is the world's largest acetone production and consumption area, accounting for 45.6% and 48.7% of the world's acetone production and consumption respectively. The second is Western Europe, where the production and consumption of acetone account for 18.5% and 17.5% respectively. The third is North America, where the production and consumption of acetone account for 18.1% and 21.0% respectively. In 2021, there will be about 60 major producers of acetone in the world, and the total capacity of the top ten producers will account for 53.9% of the world's total capacity. Ineos is the world's largest acetone manufacturer, accounting for 13.4% of the world's total production capacity, followed by Formosa Plastics Group and Mitsui Chemical. In the world acetone consumption structure, the solvent accounts for the largest proportion, followed by the production of bisphenol A, in addition, it is also used to produce MMA, MIBK, etc. In 2020, the total international trade volume of acetone was 1.37 billion US dollars, a year-on-year increase of 25.7%, and the total trade volume was 1.938 million tons, a year-on-year decrease of 7.9%. In terms of price, the average export price of acetone in the world was 708.0 US dollars/ton, with a year-on-year growth of 36.4%. China, Belgium and the Netherlands are the world's major importers of acetone, accounting for 54.6% of the world's total imports. Belgium, Taiwan, China and Thailand are the main acetone exporting countries or regions in the world, accounting for 46.9% of the world's total exports. It is expected that the world acetone production capacity will continue to grow steadily in 2023, with an average annual growth rate of 4.5% from 2019 to 2023, and an

average annual growth rate of 2.5% for downstream demand in the same period.

China's acetone supply and demand status and forecast

China's acetone production capacity are consistent with the previous year, with a substantial increase in output. In 2021, China's acetone production capacity will be the same as that of the previous year, with a year-on-year growth of 30.4% and a capacity utilization rate of 92.2%. By the end of 2021, there are 14 acetone manufacturers in China. They are located in Heilongjiang, Jilin, Tianjin, Beijing, Shandong, Jiangsu, Shanghai, Guangdong and Zhejiang. Most acetone production enterprises focus on phenol ketone plants. Lihua Yiweiyuan Chemical Co., Ltd. is the largest phenolic ketone manufacturer. Both apparent consumption and self-sufficiency rate of acetone increased. In 2021, the apparent consumption of acetone in China will increase by 13.4% year on year, and the self-sufficiency rate will increase by 10.0 percentage points compared with the previous year. China's acetone imports declined and its exports increased significantly. In 2021, China's acetone imports will decline by 11.9% year on year; The export volume increased from 100 tons to 10000 tons. China is still a net importer of acetone. China's acetone import trade is dominated by general trade and imported material processing trade. In 2021, the general trade volume of China's acetone imports will account for 68.2% of the total imports; The import processing trade accounted for 27.0%. Imports mainly come from Saudi Arabia, South Korea, Thailand and other countries or regions, accounting for 75.2% of the total imports. In the downstream consumption structure of acetone, bisphenol A accounts for a relatively large proportion, followed by MMA/acetone cyanohydrin and solvent, and is also used in isopropanol, isopropylamine, MIBK, water reducer and other fields. From 2022 to 2023, five new acetone plants will be put on the market in China, and the new capacity will reach 1 million tons/year.

Jincheng Petrochemical's 300000 ton polypropylene plant successfully trial production, 2024 polypropylene market analysis

The ABS market remains sluggish, what is the future direction?

Market differentiation of bisphenol A intensifies: prices rise in East China, while prices generally decline in other regions

The production method and process flow of silicone acrylic lotion, and what are the common raw materials